The level of US debt, already elevated before COVID-19 hit, skyrocketed as Congress put into place much needed fiscal stimulus in response to the pandemic, and it may jump again as the Biden administration targets its stimulus goals. Markets have seemed unfazed by fiscal stimulus measures, and they’ll likely stay that way at least through 2021, but there will likely be economic consequences in the long term.

DEBT LEVELS SOARING

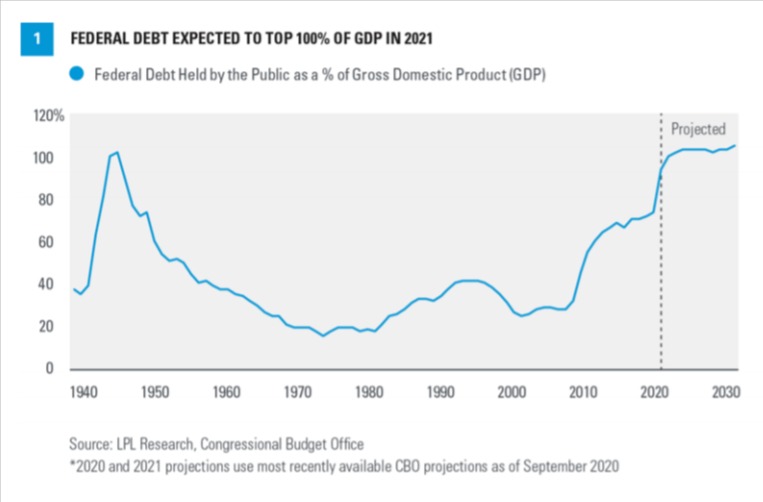

US Federal government debt is likely to pass 100% of gross domestic product (GDP) in 2021, a level only seen during the massive World War II war effort [Figure 1]. Markets have seemed largely unfazed by skyrocketing government debt levels. To the contrary, they have seemed to embrace the improved economic outlook that comes with stimulus. At the same time, concern over debt levels have become more widespread.

While some pundits have been dismissive of growing debt concerns, we think the reasons for increased scrutiny are clear and grounded in common sense. You don’t get something for nothing, so at some point rising debt levels will have consequences. There are also concerns about the moral hazard that can come with unchecked spending. Increasing debt levels may be justified, but we should at least be wary enough about it to have a sense of a reasonable point for restraint. Finally, many view the debt not as the government’s but the people’s, and we naturally want our representatives to be careful with our dollars.

Why have markets seemed indifferent to the rising national debt and when, and how, will it end? The answer to the first question is that we’re still well positioned right now for additional spending to have a reasonable positive impact on the economy with fewer of the usual risks. As to when the market indifference will end, at the very least, probably not in 2021 or even 2022. But eventually debt will likely weigh on growth, whether through periods of relative austerity or from economic consequences, but the impact can be spread out over time, especially if the political will comes around quickly enough.

ALL DEBT IS NOT CREATED EQUAL

Rising debt levels, whether through increased spending, reduced revenue (lower taxes), or both, is not always bad. It is at its worst when policymakers are simply reaping the political rewards of enabling people to spend more than they otherwise would at the cost of future spending. The impact is also worse the higher the cost of borrowing, whether directly, through high interest rates, or indirectly, through indirect economic consequences. But government debt is not always bad. Not all debt is created equal.

When can borrowing make sense? There are two main cases:

- Investment – If debt-financed investment leads to increased future economic growth, the debt can pay for itself. Similarly, if tax cuts, which also raise the debt in the near term, stimulates investment, the increased debt can also pay for itself. Sometimes the investment is simply maintenance, where the negative impact of not spending is worse than the cost of borrowing. Be careful, though. While investment can pay for the cost of debt, both Democrats and Republicans will always claim that the benefits of their debt-financed programs will outweigh the costs. Historically, both sides have often been mistaken.

- Stimulating demand – There are also times, especially during or immediately after a recession, when demand is lower than it otherwise could be, often due to a combination of uncertainty about the future leading to more cautious behavior and weaker labor markets. During these periods, stimulating demand can often have a multiplier effect, adding more to economic growth than the dollar amount spent.

So far, most of the added fiscal stimulus during the COVID-19 pandemic has likely been less costly than doing nothing. That will probably be true for at least some of any additional stimulus that might be passed, which is why markets so far appear to be responding positively to the prospect of additional government spending. We don’t have particular guidance on the right size for the next stimulus package(s), but up to some point it will be cheaper than doing nothing at all.

NOW IS A GOOD TIME TO BORROW

High national debt levels and heavy borrowing can weigh on an economy in a number of ways. Future interest payments are a drain on tax revenues. The government is competing with businesses for investment dollars, making it harder for them to have access to capital. Adding to demand when it’s not needed can increase inflation. Excess stimulus can also weaken a currency. We are actually in an economic environment that, at least for now, mitigates these risks. It doesn’t mean that governments should borrow just because they can. But it does mean if they need to, it’s a good time to do it.

- Interest rates are low – While debt levels are high, interest payments as a percent of GDP are about half the level they were at in the ‘90s. If you are going to borrow, borrow when rates are low.

- Savings levels are high – Saving levels in the United States have risen dramatically during the pandemic, due to a combination of fewer opportunities to spend, increased caution, and fiscal stimulus helping to replace some lost income. The problem of the government competing for investment dollars with businesses has a lower impact when there is ample savings.

- Structural forces are still helping to contain inflation – While stimulus will contribute to some inflation as the economy opens up, excess industrial capacity and slack in the labor market may persist for some time. Also, other forces, such as demographics and technological improvements, continue to help cap inflationary pressures.

- The dollar is still the global reserve currency – The US has a structural advantage as a borrower— the US dollar remains the dominant reserve currency. Many global transactions take place in dollars, establishing demand for the greenback, which creates demand in turn for Treasuries

BUT IS IT SUSTAINABLE?

Near-term anticipated national debt levels are sustainable in that we don’t think they’ll lead to a sudden financial crisis, but that doesn’t mean they’re without consequences. They are already leading, for example, to an inclination toward some austerity, in part because high debt levels come with uncertain risk. Ultimately, this may make it harder to provide stimulus where and when needed in the future. And debt levels likely have contributed to lower productivity gains as less efficient government spending becomes a larger part of the economy.

The biggest challenge, though, is that the continued growth of entitlement programs due to demographic pressures will increase the debt over time and will have to be addressed eventually. Unfortunately, making a genuine effort to lower the yearly deficit, never mind the accumulated national debt, is a losing political issue and there is little political will to do it. Since 1965, the US government has run a surplus in only five fiscal years, 1969 and 1998–2001. Extended delays will make the issue harder to tackle once policymakers have little alternative. But even then the solutions will be incremental, it will just have to be a bigger step. Any solution will have to work on different levels: entitlement reform (for example, raising the age at which people can take social security or adding means testing), higher taxes in some form, and lower spending.

Even then, though, the most important takeaway is that the debt will need to be addressed eventually and will likely weigh on growth, it’s unlikely to create a crisis. Japan’s debt-to-GDP ratio, to take one of the few relevant examples we have, is twice that of the United States, and while Japan does not have as robust an economy as the US, neither does it have an economy that’s in perpetual crisis.

MARKET IMPACT

The market response so far to fiscal stimulus, and the prospect of still more, has been to price in better economic growth. Those expectations have played a role in pushing up bond yields as well, although they remain extremely low. Stocks also responded positively to the stimulus measures of Presidents Reagan, G.W. Bush, Obama, and Trump even prior to the pandemic. The US is fortunate right now as a borrower. It has a good environment in which to borrow and has the opportunity to use borrowed funds productively. But there will come a time to show restraint again and get deficits back under control. We believe that the effect of a high debt level will be measurable and probably long lasting, but not obvious in our day-to-day lives and may have a negative but manageable impact on markets too. Entitlement reforms will add to the pressure, but again can be gradual. For now the main focus for markets will be on effectively reopening the economy.

Click here to download a PDF of this report.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Please read the full Outlook 2021: Powering Forward for additional description and disclosure.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

Tracking #1-05105631 (Exp. 02/22)