The first half of the year was a challenging environment for a lot of fixed income markets, especially higher-quality markets. With the Federal Reserve (Fed) seemingly unlikely to lower interest rates until after the summer months (at the earliest), the “higher for longer” narrative has kept a lid on any sort of bond market rally. While falling interest rates help provide price appreciation in this higher-for-longer environment, fixed income investors are likely better served by focusing on income opportunities, which has been the traditional goal of fixed income investors. Investors can best navigate the late cycle economic environment by adding high-quality bonds, offering attractive risk-adjusted returns, and lowering overall portfolio volatility. Consider moving away from cash, with the Fed likely to cut rates in the second half.

KEY THEMES FOR THE SECOND HALF

Sharp shifts in interest rate expectations have been a hallmark of the bond market over the last few years, but with volatility comes opportunity, and investors should consider:

- Current Bond Yield Levels Offer Opportunity: Treasury yields are near their highest levels in decades, making fixed income an attractive asset class again. Investors can build diversified portfolios with high-quality bonds offering attractive returns.

- Focus on Income: With rate cuts likely, a focus on income generation becomes more important for fixed income investors than price appreciation. Consider fixed income over cash.

- Don’t Expect Big Moves in Longer-Term Yields: An inverted yield curve suggests limited potential for significant declines in longer-term bond yields.

- Mind the Gap: Fixed income volatility in the first half was characterized by changing rate cut expectations. Second half volatility will likely be due to changing expectations on the depth of rate-cuts expected in the rate-cutting cycle. Currently, there is a gap between market expectations and Fed communication.

- Election Volatility/Noise: As we get closer to Election Day, economic policy uncertainty will likely pick up as each political party jockeys for votes. High economic uncertainty has historically been constructive for core bonds, (as explained in “Election Anxiety? Could Bonds Calm Your Fears?”) but high expected budget deficits could keep interest rates elevated.

WHY FIXED INCOME INVESTORS SHOULDN’T ROOT FOR LOWER YIELDS

Market pricing for Fed rate cuts has been volatile this year, which has meant bond prices have been volatile as well. We expect the Fed to cut rates this year once or possibly twice, with more rate cuts likely coming in 2025. But while markets continue to wait for rate cuts, a lingering question remains: how low will the Fed be able to take the fed funds rate absent a financial crisis? The answer to that question has major ramifications on the overarching shape of the U.S. Treasury yield curve and, by extension, the ability for longer-maturity Treasury yields to fall meaningfully from current levels during this Fed rate-cutting cycle.

The U.S. Treasury yield curve has been inverted since 2022 — currently the longest yield curve inversion in history. When the yield curve is inverted, shorter maturity Treasury yields are higher than longer-maturity Treasury yields. This is not the normal shape of the yield curve. In normal times, the yield curve is upward-sloping, meaning longer-maturity Treasury yields are higher than shorter-maturity Treasury yields, which makes sense since longer-maturity Treasury securities carry more risk as interest rates can fluctuate more over time and investors want to get paid more to take on that additional risk.

In order for the yield curve to normalize, one of two things could happen: short rates could fall more than long rates (bull steepening), or long rates could climb more than short rates (bear steepening). Historically, once the Fed starts to cut rates, the yield curve normalizes by bull steepening, which is a good thing for fixed income investors. In this current environment though, where the economy has been able to mostly shrug off higher interest rates, the Fed may not need to take the fed funds rate back down to very low levels, which means longer-maturity Treasury yields may not fall much from current levels.

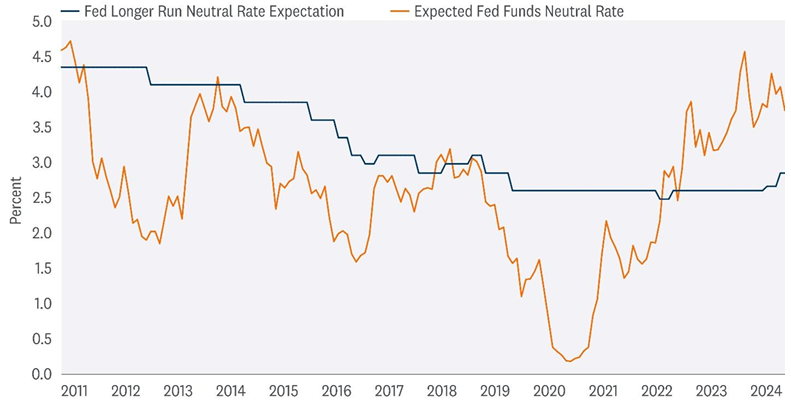

Current market pricing suggests the Fed will only take the fed funds rate back to just under 4% or so before stopping its rate-cutting campaign. Absent an economy that slows more than we expect, the 4% fed funds rate will keep longer-maturity yields from falling meaningfully from current levels. Historically, the Fed has followed market pricing for the determination of the neutral rate. Since 2011, markets have generally assumed the neutral rate would drift lower over time, but that seemingly changed after the COVID-19 pandemic. Since bottoming close to zero, markets have repriced the neutral rate higher over the last few years. The question remains: will the Fed follow suit and raise its estimation of neutral? If so, that likely means interest rates across all maturities are set to be higher than they were over the past decade.

MARKETS ARE PRICING IN A HIGHER NEUTRAL RATE

If Markets Are Right, Yields May Not Fall Much from Current Levels

Source: LPL Research, Bloomberg 07/17/24

Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

Now, as we’ve seen this year, market pricing for the Fed’s reaction function has been volatile. That said, we still expect the 10-year Treasury yield to end the year in the 3.75% to 4.25% range, as a moderately slowing economy and sticky inflation likely lead to only a gradual reduction in interest rates over the next two years.

DON’T FORGET ABOUT INCOME

Fixed income instruments are fundamentally different than other financial instruments. Bonds are financial obligations that are contractually obligated to pay periodic coupons and return principal at or near par at the maturity of the bond. That is, absent of defaults, there is a certainty with bonds that you don’t get from many other financial instruments. And because starting yields consider the underlying price of the bond as well as the required coupon payments, starting yields are the best predictor of future returns.

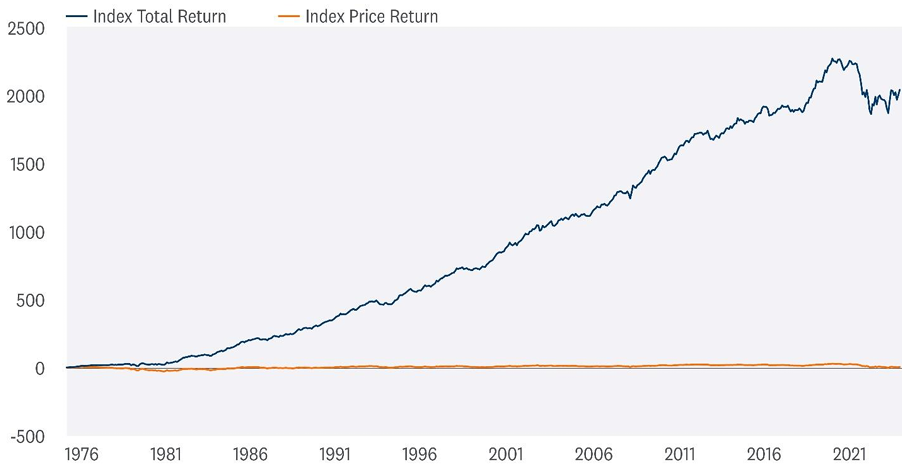

For many financial markets, the primary driver of total returns is price appreciation. You buy a stock, for example, and total returns are largely predicated on the price of that stock going higher (though dividends play a role). For bonds, it’s different. Most of the time, bonds are bought at or near par, and the return is driven by the income component. In fact, since the inception of the Bloomberg Aggregate Bond Index, over 90% of total returns have come from the income component with the remainder coming from price appreciation. Moreover, using just the near 40-year period of falling interest rates (1981 to 2017), research has shown that only about 25% of the annualized returns came from price appreciation, with the overwhelming majority of returns coming from interest income. So, despite what has been called the great bond bull market due to falling interest rates, it was the high starting coupon rates that were the primary driver of returns.

INCOME HAS BEEN THE LARGEST CONTRIBUTOR TO TOTAL RETURNS OVER TIME

Bloomberg Aggregate Bond Index Returns Since Inception

Source: LPL Research, Bloomberg 07/17/24

Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The Aggregate Bond Index has been maintained by Bloomberg L.P. since August 24, 2016. Prior to then it was known as the Barclays Capital Aggregate Bond Index and was maintained by Barclays. From June 1976 to November 2008, it was known as the Lehman Aggregate Bond Index.

In today’s fixed income environment and after the backup in bond yields that we’ve seen over the last few years, we’re back to, historically, more normal interest rate levels. As such, it is unlikely we’re going to see a large decline in bond yields (absent a financial crisis or other “black swan” type event), so total returns for fixed income investors are likely going to be dominated by interest income. While the optionality of price appreciation remains, fixed income returns have historically been predicated on income and have correlated highly with starting yields. And with starting yields still among the highest levels in decades, the income component within fixed income is as attractive as it’s been in a long time.

Right now, investors can build a high-quality fixed income portfolio of U.S. Treasury securities, AAA-rated Agency mortgage-backed securities (MBS), and short-maturity investment grade corporates that can generate attractive income. Investors don’t have to “reach for yield” anymore by taking on a lot of risk to meet their income needs. And for those investors concerned about still higher yields, consider laddered portfolios and individual bonds held to maturity to take advantage of these higher yields. We think the current environment is ripe with income opportunities that, when combined with equities, can help reduce overall levels of portfolio volatility and position investors better for longer-term success.

FIXED INCOME: LIKE CASH BUT BETTER

After a decade of cash yields that were close to zero, the Fed’s aggressive rate-hiking campaign has pushed cash rates up, and investors have taken advantage by parking nearly $6 trillion in cash accounts. And while cash yields are attractive, another attractive attribute of cash is the low risk associated with cash. Cash has done a great job in recent years helping investors preserve their portfolios from market turbulence. That was especially true in 2022, when both stocks and bonds experienced large drawdowns. But with Fed interest rate hikes likely behind us, cash may not be as important of an asset class to portfolios as it was recently.

And we know those cash rates aren’t going to last forever. Just as the aggressive rate-hiking cycle took Treasury yields higher, interest rate cuts will take all cash rates lower. However, with bond yields still elevated and likely to stay around current levels, investors can extend the maturity of their excess cash holdings by locking in current bond yields (not too far out on the curve, though). Locking into high-quality, intermediate-term fixed income can provide consistent cash flow and desirable income levels for years to come, regardless of what lies around the corner.

Moreover, there is an optionality that you get from bonds that you don’t get from cash. While current yields for bonds and cash are similar, bonds offer portfolio preservation and potential price appreciation if an unexpected event negatively impacts the economy that you don’t get from cash. Additionally, over the past 40 years (ending April 2024), bonds have averaged a 6.1% annual return versus about 3.5% for cash. And bonds have been consistent outperformers. From January 1986 to April 2024, bonds had a better 5-year return in 95% of the rolling 5-year returns. In those few instances where cash did better, it only outperformed by 0.38% on average. So, with cash rates likely to fall as the Fed cuts rates, bonds have done a better job than cash at helping investors grow their assets over the long term.

BONDS TEND TO OUTPERFORM CASH OVER TIME

Trailing 5-Year Annualized Total Returns

Source: LPL Research, Bloomberg 07/17/24

The Aggregate Bond Index has been maintained by Bloomberg L.P. since August 24, 2016. Prior to then it was known as the Barclays Capital Aggregate Bond Index and was maintained by Barclays. From June 1976 to November 2008, it was known as the Lehman Aggregate Bond Index.

While we certainly think cash is a legitimate asset class again, unless investors have short-term income needs, they may be better served by reducing some of their excess cash holdings and by extending the maturity profile of their fixed income portfolio to lock in these higher yields for longer. Bond funds and ETFs that track the Bloomberg Aggregate Index, along with separately managed accounts and laddered portfolios, all represent attractive options that will allow investors to take advantage of these higher rates before they disappear.

FIXED INCOME MATTERS AGAIN

The move higher in Treasury yields over the past few years has been unrelenting, with intermediate and longer-term Treasury yields bearing the brunt of the more recent moves. The Fed is expected to start reducing interest rates later this year, which should provide relief to fixed income investors. However, with the Treasury yield curve still inverted, it’s possible that we don’t get the kind of reaction from longer-maturity securities that we’ve seen in the past.

The Treasury Department is still expected to issue a record amount of Treasury securities to fund budget deficits, and with the Bank of Japan (BOJ) slowly ending its aggressively loose monetary policies in 2024, we could continue to see upward pressure on yields. However, while supply/demand dynamics can influence prices in the near term, the long-term direction of yields is based on expected Fed policy. That doesn’t mean rates are going to fall dramatically from current levels though, and that is fine for the longer-term prospects for fixed income investors since coupon, and not price appreciation, has historically been the largest component of total returns.

With yields back to levels last seen over a decade ago, we think bonds are an attractive asset class again. There are three primary reasons to own fixed income: diversification, liquidity, and income. And with the recent increase in yields, fixed income is providing income again.

CONCLUSION

The focus for fixed income investors should shift back to the traditional benefit of bonds: income generation. Current high starting yields offer attractive risk-adjusted returns, even without significant price appreciation. Additionally, bonds can help reduce overall portfolio volatility compared to stocks. With the Fed likely to begin cutting rates this fall, investors should consider using bonds to replace some cash holdings. By moving into high-quality fixed income, investors can lock in these attractive yields for longer and fortify their overall portfolios.

ASSET ALLOCATION INSIGHTS

The LPL Strategic and Tactical Asset Allocation Committee (STAAC) maintains its recommended neutral equities allocation amid a favorable economic and profit backdrop. Interest rates may need to fall for valuations to hold, so potential second-half gains are more likely to be driven by earnings growth. The Committee remains comfortable with a balanced approach to market cap. High-quality small cap stocks are attractively valued, but the earnings power among large cap companies overall has been very impressive. The Committee maintains a slight preference towards large cap growth. Artificial intelligence (AI)-fueled earnings growth, potentially lower interest rates as the economy slows, and our technical analysis work favors the growth style. Finally, the STAAC’s regional preference remains U.S. over developed international and emerging markets (EM) due largely to superior earnings and economic growth in the U.S.

The STAAC continues to recommend a modest overweight to fixed income, funded from cash, with a strong overweight tilt in preferred securities as valuations remain attractive and a recommended neutral duration posture relative to benchmarks. The risk/reward for core bond sectors (U.S. Treasury, agency mortgage-backed securities (MBS), investment-grade corporates) is more attractive than plus sectors.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The market value of corporate bonds will fluctuate, and if the bond is sold prior to maturity, the investor’s yield may differ from the advertised yield.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

The prices of small cap stocks are generally more volatile than large cap stocks.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

All index data provided by Factset.

LPL Financial does not provide investment banking services and does not engage in initial public offerings or merger and acquisition activities.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

RES-0001517-0624W | For Public Use | Tracking # 605174 (Exp. 07/2025)