The dollar’s continued climb higher has been predicated on a host of factors — including the rise in geopolitical risk and the dollar’s safe haven status as inflows have picked up markedly, uncertainty with regard to the Federal Reserve’s (Fed) interest rate move in December, a solid domestic economic landscape with inflation still “sticky,” a weakening euro as expectations suggest the potential for a stronger rate cut, and questions regarding the inflationary implications of the Trump administration’s tariff agenda. With more questions than answers, the dollar’s ascent is expected to continue — or level off — until there’s more definitive information regarding the extent of tariffs, and on the other side of the equation, the effect of retaliatory tariffs. Global capital markets seek clarity, particularly the currency market.

King Dollar’s Rise Amid a Basket of Global Uncertainty

The dollar delivered for yet another week of strength against its global peers as geopolitical risk has edged higher with the escalation of the Ukraine/Russia conflict. The dollar, considered a safe haven during periods of heightened global tension, has witnessed heavier inflows as the latest — and potentially most dangerous — phase of the military combat between the two warring nations unfolds.

In addition, as the most current economic data releases from the Eurozone area suggest further weakening, expectations for a December interest rate cut from the European Central Bank (ECB) have climbed markedly higher, pushing the euro dramatically lower against the dollar, as the currency market questions whether the Fed “pauses” at its December meeting or goes ahead with another rate cut.

Within the parlance of the currency world, the so-called “interest rate differential” between the euro and the dollar is pushing the dollar higher. Markets have begun pricing in a more “dovish” ECB, perhaps even cutting rates by 50 basis points (half of one percent) rather than the expected 25 basis points (one quarter of one percent) versus a Fed that may hold back a rate cut, characterizing the Fed as more “hawkish.” Against the British pound sterling, newly released softer economic data in the U.K versus a series of solid economic reports and slightly higher inflation concerns in the U.S. have propelled the dollar higher against the pound.

Perhaps more significantly, the dollar has been underpinned by uncertainty surrounding the effect of Trump-administration tariffs on consumer prices and ensuing inflation. The question for currency markets is whether the administration goes full throttle on the extent of the tariffs implied by President-elect Trump during the political campaign, and on the other side of the tariff equation, the retaliatory responses from the country’s trading partners.

The final line for currency markets is how much inflation is inherent in the tariffs once enacted and how the Fed’s monetary policy is impacted.

Going into the shortened trading holiday week, the dollar eased as the market applauded the nomination of Scott Bessent to head the Treasury Department. Bessent has been dubbed a “fiscal hawk” as someone who can navigate a broad cross-section of global asset classes and the implications of the crosscurrents underpinning them. Moreover, markets are surmising that Bessent will help steer the incoming administration’s policies towards a pro-growth posture, but without the ramifications of inflationary consequences

Dollar Sees Resurgence

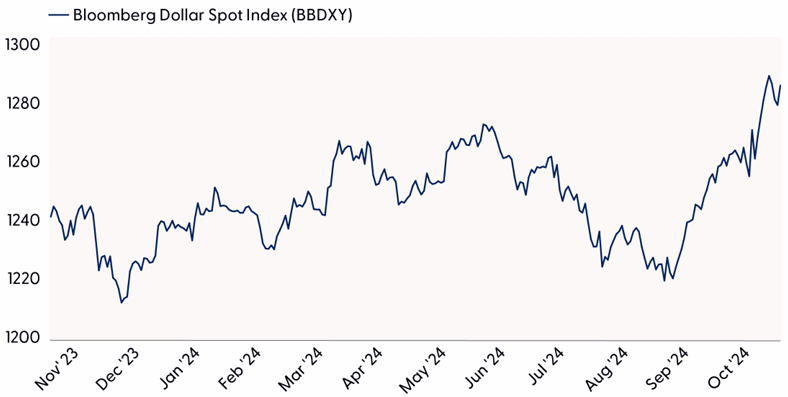

Dollar Reaches New Annual High After Late Year Jump

Source: LPL Research, Bloomberg 11/20/2024

Disclosures: Indexes are unmanaged and cannot be invested in directly. Past Performance is no guarantee of future results.

The Interest Rate Differential

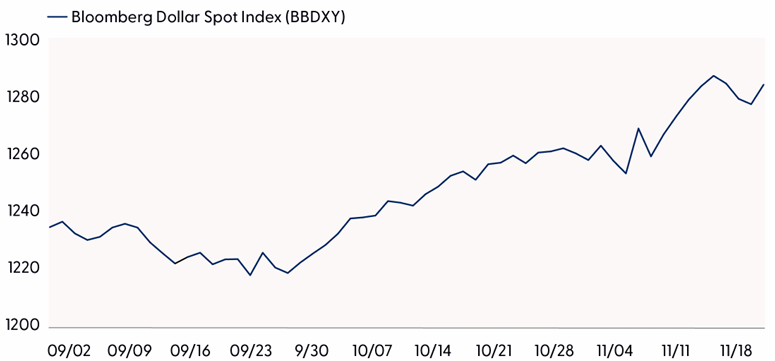

The current rally for the dollar has reached eight consecutive weeks of a veritable force vis-à-vis the basket of currencies constituting the country’s primary trading partners. Whether it’s the U.S. Dollar Index (DXY), or the Bloomberg Dollar Spot Index (BBDXY), the pattern is clear in the upward trajectory of the dollar.

As currencies don’t rise or fall on their own but rather against a single currency or a basket of currencies, the dollar has been supported by a myriad of catalysts, including a host of solid economic data versus softening economic conditions within the broader global economic landscape, including the euro area and the United Kingdom (U.K.); and more generally, considerably slower growth in China, which is having a negative effect on the Eurozone.

And as the Fed has injected uncertainty regarding what the market had initially perceived as a near-certain interest rate cut at its December 18 meeting, the dollar is reflecting a stronger possibility that the Fed may “pause” in terms of easing policy again. Should expectations change between now and December 18, particularly with regard to the labor market, the dollar could soften if the labor market displays signs of “cooling” too much, in the Fed’s words. Markets would expect the Fed to cut rates as it’s often mentioned by Fed Chair Jerome Powell that the Fed would cut rates to help a struggling labor market, as the Fed is bound by its congressional mandate to support “maximum employment.” Currently, this is a definitive “what if” scenario and not being factored into what the currency market expects.

Dollar Continues Its Upward Movement

Potential for Tariffs Sends the Dollar Higher Following 2024 Election Result

Source: LPL Research, Bloomberg 11/20/2024

Disclosures: Indexes are unmanaged and cannot be invested in directly. Past Performance is no guarantee of future results.

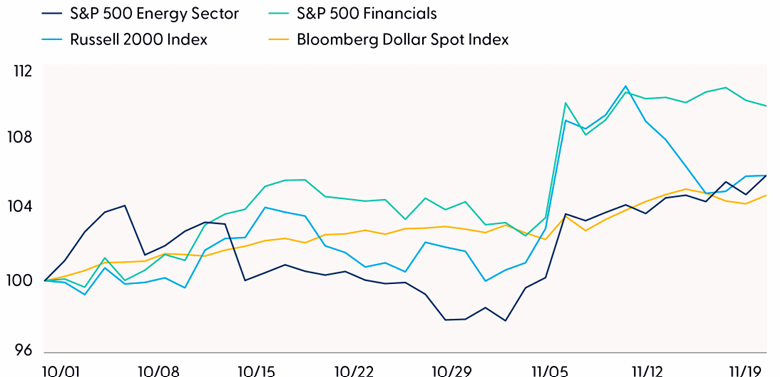

The Effect of a Trump Victory

As the dollar began its upward path at a more strident rate in October, as nearly all areas of capital markets began assessing election outcomes, the dollar’s rise matched a similar move in equities as those sectors most closely aligned with a Trump victory began to outperform.

Specifically, it was the promise of heavy tariffs — 60% on Chinese goods and potentially 20% on other countries — imposed on the country’s trading partners that became the focus of the dollar, as analysts have been trying to assess what the effect on inflation could ultimately be, in concert with other elements of the Trump agenda to promote stronger economic growth, more jobs, and plans to bolster domestic manufacturing.

Even at the margin, as the debate over inflationary scenarios has dominated headlines, inflation is projected to be higher. Following the inflation thesis, the Fed would, by necessity, be compelled to keep rates higher in order to quell inflation. Accordingly, the dollar would be higher as the Fed would become decidedly more “hawkish.”

Dollar Sees Slight Growth During 2024 Election Buildup

Dollar Moves Higher Alongside Trump-Friendly Sectors

Source: LPL Research, Bloomberg 11/20/2024

Disclosures: Indexes are unmanaged and cannot be invested in directly. Past Performance is no guarantee of future results.

Downside of a Strong Dollar

During a previous strong dollar run in 2022, as it became increasingly clear the Fed would begin its campaign to curb inflation, the dollar began moving ahead of the pound and euro as Fed rhetoric became more aggressive, coupled with the higher-rate regime commencing in March 2022.

Also, with the onset of the Ukraine/Russia conflict in February 2022, the dollar became an important safe haven destination, boosting the currency.

By the summer of 2022, S&P 500 exporters began to feel the full brunt of the dollar’s strength. With 35–40% of the index reliant on exports, the theme during the summer earnings season was one of complaints from Microsoft (MSFT), Procter & Gamble (PG), Coca-Cola (KO), and Philip Morris (PM) among others, of how the strong dollar was hindering sales.

If the dollar continues at its torrid pace, it won’t be long before its continuing strength is increasingly mentioned in upcoming earnings calls.

Increasing Clarity for the Dollar

The path and pace of the dollar will be predicated on the flow of information from the incoming administration, especially in regard to trade policy. Markets across the board — and globally — will be affected, including Treasuries and global bonds, equities, commodities, and ultimately the fed funds futures market as it attempts to decipher how the Fed will interpret and assimilate new information as it anticipates policy.

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, with a preference for the U.S., a slight tilt toward growth, and benchmark-like exposure across the market capitalization spectrum. However, we do not rule out the possibility of short-term weakness, especially as geopolitical threats escalate. Equities may also readjust to what may be a slower and shallower Fed rate-cutting cycle than markets are currently pricing in, although both post-election and fourth-quarter seasonality are favorable for stocks.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0002171-1024W Tracking # 662173/662250 (Exp. 11/25))